Statistics show an even year

The latest statistics show that the volume of recycled and reused packaging materials has remained at quite an even level in 2012 and 2013. The only significant change in the figures was caused by the change in the data compilation method for wooden packaging.

The statistics can be found at the end of this article.

Previously, the quantity of reused wooden packaging was an estimation based on data gathered from various sources, but since 2013 these figures have been actual volumes provided by producers to Finnish Packaging Recycling RINKI Ltd (previously PYR Ltd).

“It is important that the producers ensure that the figures they provide are correct, since this may result in considerable savings in the recycling fees,” explains managing director Jukka Ala-Viikari from Puupakkausten Kierrätys PPK Oy, the organisation responsible for recycling of wooden packaging.

Wooden packaging include pallets, pallet boxes and other platforms, frames, crates, boxes, barrels, containers, cable reels, layer boards and supports. The main users of wooden packaging are construction, food and forest industries as well as mechanical and steel industries and the retail sector.

According to Ala-Viikari, recycling of wooden packaging material is a challenge in Finland. Forests produce far more timber than is harvested, and there are plenty of virgin timber products on the market. The use of wooden packaging waste in composting is in decline.

“The wooden packaging waste that is not reused in any other way is, however, used in energy production. Unfortunately, this type of use is not accepted as recycling as yet. The methods of repairing wooden packaging that are considered recycling is expensive and highly competitive, which means that even wooden packaging that would be repairable now ends up as woodchips.”

Challenging obligations

Ala-Viikari thinks that the situation will turn even more difficult in terms of recycling. Fulfilling the recycling obligation will be a challenge, and it will also incur costs. If agreed upon, the stricter obligations predicted to come into force in the next few years will increase the challenges and costs.

He does conclude, however, that the preliminary figures for reuse in 2014 appear to be somewhat better than those for 2013. In Finland, the reuse process is well-organised, and this should be taken into account in the determination of recycling targets. It is also good that the new method of compiling statistics produces figures that better reflect reality.

Ala-Viikari says that this is also supported by the form and guidelines that now require far more detailed information.

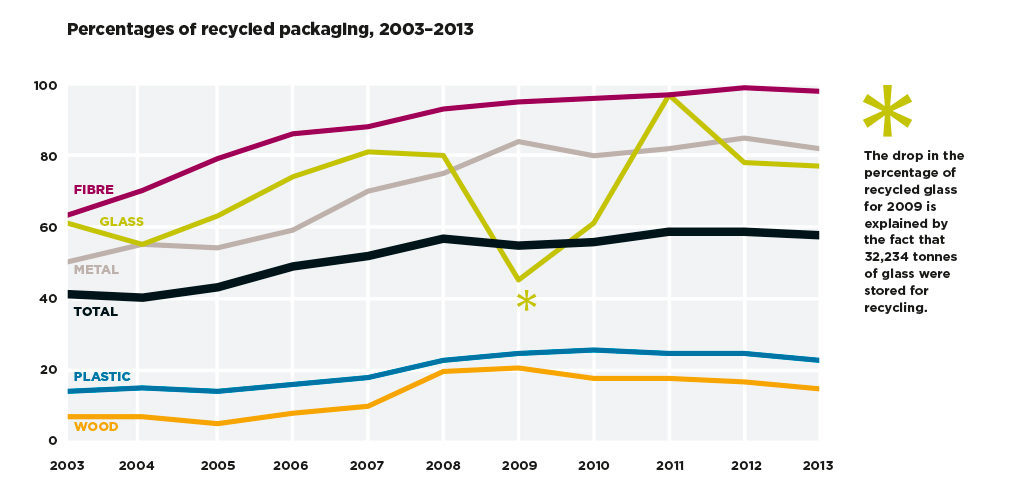

There is also a slight decrease in the figures for the reuse of glass packaging, although this change is quite insignificant.

The decree on packaging waste that came into force last summer defines a separate recycling rate for non-deposit glass packaging as of 2016. Previously there was no particular recycling obligation for non-deposit glass packaging but it was possible to combine the volumes of recycled deposit and non-deposit glass packaging.

Suomen Keräyslasiyhdistys ry (SKY), the organisation of glass packaging producers, is responsible for ensuring that the level set for non-deposit glass packaging recycling is achieved. SKY’s managing director Maija Peltola says that a considerable portion of the glass packaging waste collected by municipalities has been reused by the construction sector.

Peltola explains that the sorting guidelines have been quite loose in some parts of Finland. According to the new requirements, more material should be recycled and, consequently, the sorting process must be standardised everywhere the country. As a result of the changes, more non-deposit glass will be recycled but how quickly this can be done depends entirely on the quality of the material collected.

For deposit glass packaging, the situation changed significantly in 2012, when Suomen Palautuspakkaus Oy (Palpa) launched a collection system for deposit glass bottles. With the new system, consumers could return bottles bought in Alkos, the state-run off-licences, to grocery shops. This has been a success, and the recycling rate has remained high, at around 90% between 2012 and 2014.

“The recycling of cans and recyclable plastic bottles is also going well. The return rates are high in global terms, and numerous delegates from overseas have visited Palpa to see how the deposit-based recycling system works. The recycling rate for cans has stayed at 96% for several years now, and for recyclable plastic bottles the rate is around 92%,” says Palpa’s managing director Pasi Nurminen.

“Finns are conscientious recyclers of beverage packages, and since the network of take-back points is comprehensive and works well, we can expect the recycling rate to remain high also in future,” says Nurminen.

More changes coming

RINKI Oy’s CEO Juha-Heikki Tanskanen says that the recycling targets have been achieved in every sector so the current situation is satisfying.

“There will be more changes, however, and the targets will be set even higher. The new packaging decree already sets stricter targets for 2016 and 2020, and the circular economy package being prepared in the EU is likely to set the targets even higher.”

The expansion of producer responsibility is the topic in Finland at the moment as the responsibility for collecting and recycling of consumer packaging is transferred from municipalities to retailers and industry. According to the decree, the take-back network must be in place at the beginning of the new year.

“As soon as the new system is up and running we will start seeing its impact on recycling. In order to achieve the objectives, the recycling rate of packaging waste must increase by seven percentage points by 2020, so a steady increase is needed.”

The expanded producer responsibility has considerably raised the recycling fees paid by producers.

“Time will show if this has any impact on the proportional volumes and use of various packaging materials in the new few years. However, competition between the various materials is evened out by the fact that recycling fees are increasing considerably for every material.”

Consumers to be more active

Tanskanen does not expect to see significant changes in the recycling and reuse figures for 2014 and 2015. When the extended producer responsibility enters into force in 2016, it will mainly impact the recycling of consumer packaging.

“I do not expect anything dramatic to happen. Most of the material will continue to be collected from businesses and residential premises. Of course it will be interesting to see how the new system works and what consequences there will be. The presumption is that the volumes of recycled materials will probably increase as there will be hundreds of new take-back points in shopping areas,” says Tanskanen.

Text by Ilpo Salonen